5 Tips for Success: Teaching Children About Money

So you want to teach your child about money but have no idea where to start…or maybe you don’t feel confident being their money role model?

Don’t worry, you are NOT alone!

I don’t know about you but most parents feel that they are never quite the perfect role model for their child that they would like to be right?

For example, when it comes to money maybe you are not where you want to be financially and so you don’t feel qualified to teach your child right?

Again, no worries at all…

That’s where I come in!

“Your the perfect role model for my child?”

ABSOLUTELY!!!

“Hey that sure sounds stuck up and egotistical.”

I know right? Well, it’s not. I’m a perfect example of what to do and what NOT to do!

“Ah! Now you’re talking!”

And guess what?

“What?”

You are too!

You are too!

“Me?”

Of course. Don’t you see, by being completely open with our kiddos about all of our financial successes as well as our failures we are being great role models for our kiddos!

They will watch the successes and mirror those, and as long as we explain and really show our kids our failures…and the consequences of those failures…and how we fix them…

Then our children will get the most amazing opportunity of their lives:

To live vicariously through our mistakes so they avoid those when they grow up and focus on mirroring our successes instead!

See?

“I guess…”

Oh don’t go too deeply here, be kind on yourself. You see the only way you can mess up is…

…TO NOT SHARE YOUR MISTAKES WITH YOUR CHILD!

“Huh?”

When you hide your failures, your child only sees the ‘results’ of those failures: the stress, the lack of money, the panic every time a bill comes in that needs immediate payment or else! etc.

Our kids are smart. What we don’t tell them, they feel anyway!

Don’t kid yourself! Even when we try to hide and protect them from our financial mistakes they feel it. They know.

So what can we do?

Be open and honest with them!

It really is the best way to go. Look your child is going to have financial failures at some stage in their life. There is no way around it. It’s a part of our learning curve and it’s a very important part. But what we can do is teach them how to behave during those times. Give them tools so they’ll know how to react when life hits them hard.

It’s not about helping them completely avoid every pitfall but… it’s about equipping them to be ready for them; to take those failures by the horns and turn them into great future successes!

Today I want to help you with that by giving you 5 simple steps for teaching your child how to be a success with their money.

Here’s a short video that shows them all to you, after you watch the video…and share it with your friends of course…hey I have to do a plug every now and then right? ;)….then read below and I’ll take you through each of the 5 steps so you’ll know exactly how to make sure your child is fully equipped with the financial knowledge they will need to not only survive financially but THRIVE!!!

It’s time to stop being your child’s personal ATM bank machine! Time for them to figure out their own way to make money and more importantly how to manage their money so it will work hard for them for the rest of their lives!

“5 Tips to Success: Teaching Children About Money”

Okay now let’s go through each part of that video so you can get the most out of it and get your child onto financial success from a young age!

Our goal here is to turn your child into a Money Expert!

A force for financial good in our world!

The first thing we need to do is get our kids excited to actually WANT to learn about money!

“How do you do that?”

Easy, you make it personal!

You get them to set some goals, things that they’d like to do, go, have, be, etc. Make sure that their goals involve money in some way, shape or form so they are able to attain their goal by paying for it.

They could pay for lessons, if they wanted to learn how to play guitar, for example. They could pay their own tickets to an amusement park, they could buy a toy, etc.

But it needs to involve money to get to their goal so they’ll be excited to learn how to make their own money.

So “Goal Setting” is Step 1:

- Click here to grab a free copy of “Goal Setting for Families” if you haven’t already. Simply log into your members-only area to download it for free. Remember membership is free too!

- Click here to learn even more about how to make sure your child’s goals (and your own) actually come true!

The next step is to decide on whether or not you are going to help your child earn money through giving then an allowance or not.

This is a very personal choice and you have to feel comfortable with what you decide to do when it comes to allowances, whether or not to make ‘to-do’ or ‘chore’ lists, etc. that they have to accomplish before they get an allowance or whether you take the time to help them come up with more creative ways to earn their own money…that keeps them out of your pocket!!

So deciding whether or not to give an “Allowance” is Step 2:

- Click here to grab a free copy of “Allowance Secrets: To Give or Not to Give?” if you haven’t already. Simply log into your members-only area to download it for free. Remember membership is free too!

- Click here to learn even more about whether or not you should give your child an allowance or if there are any alternatives?

Whether or not you decide to give your child an allowance, you’ll still want to start setting them up for financial success by teaching them to find ways to earn their own money…not to mention that will keep their grimy little hands out of your pockets!

Take bowling for an example: Is your child an excellent bowler, hitting strikes every single time he goes up for his turn? Or does he have a special way to hold the bowling ball so it flies like a bird right out of his hands? Did you know that he could create a video showing other kids how to do those same tricks or techniques and get paid for teaching them?

Very true in deed!

There are so many incredible and fun ways for kids and teens nowadays to earn their own money both online and off that they would be too numerous to mention here. Ask your child for an idea and I am willing to bet that you will be pleasantly surprised at their imagination!

So Deciding on “Money Making Ideas for Your Child” is Step 3:

- Click here to grab a free copy of “50 Money Making Ideas for Kids and Teens” if you haven’t already. Simply log into your members-only area to download it for free. Remember membership is free too!

- Click here to learn even more about some other fun ways your child can earn their own money using their natural talents and passions…like bowling!

Once your child is earning their own money then it’s time to start teaching them how to manage their money so that their money will work hard for them…instead of your child always having to work hard for their money for the rest of their lives!

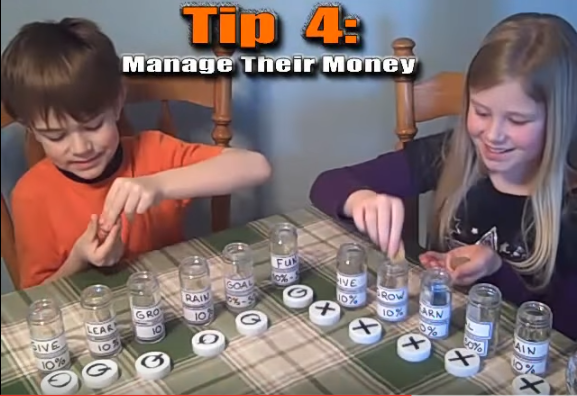

In my course, “Teaching Children About Money 2.0” I teach my “6 Magical Piggy Banks” system. Learning to divide their money into specific money jars so that their money can work hard for them is the key to their financial education and ultimate financial success!

So “Making Their Money Work Hard for Them” is Step 4:

- Click here to grab a free copy of “The 6 Magical Piggy Banks – Money Management System” video if you haven’t already. Simply log into your members-only area to download it for free. Remember membership is free too!

- Click here to watch “The 6 Magical Piggy Banks” Cartoon with your child!

Knowing how to handle money is one thing…and a VERY IMPORTANT one for sure! But another equally important financial lesson is know how to grow a Healthy Wealth Mentality.

“A what?”

You see, the way you THINK about money actually affects how much money you get to keep! You don’t want your child to turn into Ebeneezer Scrooge do you?

“NO WAY!”

I didn’t think so. Ask yourself, the last time your child asked you to buy them something and you didn’t have the money to get it, what did you say to your child?

“Sorry sweetie, we can’t afford that.”

or…

“What do you think I’m MADE of money!”

Well, if you did anything like that, then I’m betting you had no idea what the consequences were of your words on how your child’s financial future would turn out, did you?

“What are you saying? But I really couldn’t afford it…and besides, I’m not going to just buy her everything she wants! I don’t want a spoiled kid!”

You’re absolutely right! That’s not what we want for sure…but we also don’t want our kids to have a ‘scarcity’ mentality.

“What’s that? A Scarcity…what?”

A Scarcity Mentality: It’s a way of thinking, and it’s definitely NOT a good way of thinking. It makes your child feel ‘unworthy’, ‘not good enough’, ‘good things only come to others, never to me’, ‘I don’t deserve…’, etc.

“Okay, fine, so what would I say then if I really don’t have the money or just don’t want to indulge?”

That’s a very fair question.

How about changing the tone of the answer, by saying something like:

“I choose not to spend my money on this right now” = EMPOWERMENT

or…

“Sure, that’s a great idea, now how can YOU earn the money to buy it yourself?” = RESPONSIBILITY

“Oh I get it, we’re not saying yes, we’re just putting it back on them to find a way to make it happen if they really want it or we’re saying that it’s our choice not to get something right now, that we are in charge of our financial situation…that’s really cool! I like that idea. Thanks!”

My pleasure. Hey, that’s what I’m here for: to help you with tools and techniques to help you teach your child about money so they become a Master of their finances and live a life of their dreams…knowing how to make them into a reality!

So Nurturing a “Healthy Wealth Mentality” is step #5:

- Click here to grab a free copy of your 2 pre-made “Mindmovies for Kids and Teens” if you haven’t already. Simply log into your members-only area to download it for free. Remember membership is free too!

- Click here to learn even more about how our own wealth mentality affects our kids?

Together we can change the world!

Here’s to your child’s Financial Success!

Cheers…Amanda…Excited Life Enthusiast! ;o)

P. S. Did you find this article helpful? If so, then please help me empower more kids, teens and their families by leaving me your own comments below and clicking the ‘like’ button and ‘sharing’ it with your friends on Facebook, Twitter, Snapchat, Instagram, Pinterest, etc. Thank-you for helping me empower more Healthy Wealth Mentality kiddos. We need them!

“Together we can raise kids and teens who are money savvy and get to follow their dreams because they know how to handle and value their money…and not come back crawling home to mom and dad to get them out of financial trouble!”

Comments

Comments Posts

Posts

FREEDOM !)

FREEDOM !) WARNING ?)

WARNING ?) OPT ???)

OPT ???) MAGICAL PIGGY BANKS ?)

MAGICAL PIGGY BANKS ?)

6 Responses to 5 Tips To Success: Teaching Children About Money